Table of Contents

For fleet decision-makers and operators, legacy methods are a direct path to competitive disadvantage. Adopting IoT in fleet management is not an incremental tech upgrade; it’s a fundamental operational shift required to maintain profitability and reliability. This technology provides proactive control over assets, replacing reactive problem-solving with predictive, real-time optimization.

The Strategic Shift to IoT in Fleet Operations

Fleet operators face persistent pressure from volatile fuel costs, the high impact of vehicle downtime, tightening regulations, and the constant imperative of driver safety. Traditional models, reliant on historical reports and manual check-ins, create operational blind spots that lead directly to asset underutilization and inflated costs. The root cause is a lack of granular, real-time data.

IoT in fleet management directly addresses this data latency. It enables a decisive move to a data-driven, proactive model where decisions are based on live operational intelligence, not lagging indicators. By instrumenting vehicles with a network of sensors and telematics gateways, operators gain an unprecedented, real-time view into every facet of fleet operations.

This shift transforms a fleet from a reactive cost center into a resilient, efficient, and profitable asset. The business impact is clear:

- Risk Reduction: Proactively monitor high-risk driver behaviors like harsh braking or speeding. This data can directly support safety programs and potentially lower insurance premiums.

- Cost Control: Optimize routes dynamically to mitigate traffic, reduce engine idle time, and minimize fuel burn. Every gallon of fuel saved directly impacts the bottom line.

- Enhanced Reliability: Implement predictive maintenance schedules based on actual vehicle performance data, not arbitrary mileage intervals. This prevents costly and disruptive roadside failures.

- Improved Scalability: Automate compliance reporting and operational workflows, allowing the fleet to grow without a proportional increase in administrative overhead.

Diagnosing the Failure of Traditional Models

To grasp the impact of this shift, one must first diagnose the failure of legacy models. As detailed in this guide to modern fleet management for UK businesses, traditional approaches are inherently backward-looking. A manager might identify an inefficient route only after analyzing weeks of fuel receipts, but by then, the capital has been wasted.

The core failure of legacy fleet management is its latency. By the time a problem is identified through manual reports or after-the-fact analysis, the opportunity for immediate, cost-saving intervention is lost. IoT closes this gap, turning data into action in seconds, not weeks.

This is not a niche trend; it’s a market-wide transformation. The global IoT fleet management market was valued at USD 7,030.8 million in 2023 and is projected to reach USD 20,609.6 million by 2030, according to Grand View Research. This growth is driven by the defensible ROI that connected vehicles deliver through smarter decisions on routing, maintenance, and compliance. You can review the complete IoT in fleet management market trends for a deeper analysis.

Ultimately, integrating IoT is about re-architecting the operational nervous system of the fleet to be more resilient and profitable in a hyper-competitive environment.

Breaking Down Your IoT Fleet Management Architecture

For engineering and operations leaders, understanding the system’s architecture is non-negotiable for a successful deployment. A robust IoT fleet management solution is not a monolithic product; it is a layered system where hardware, connectivity, and software must function cohesively. The architectural decisions made at each layer directly dictate cost, scalability, and the quality of actionable intelligence the system can produce.

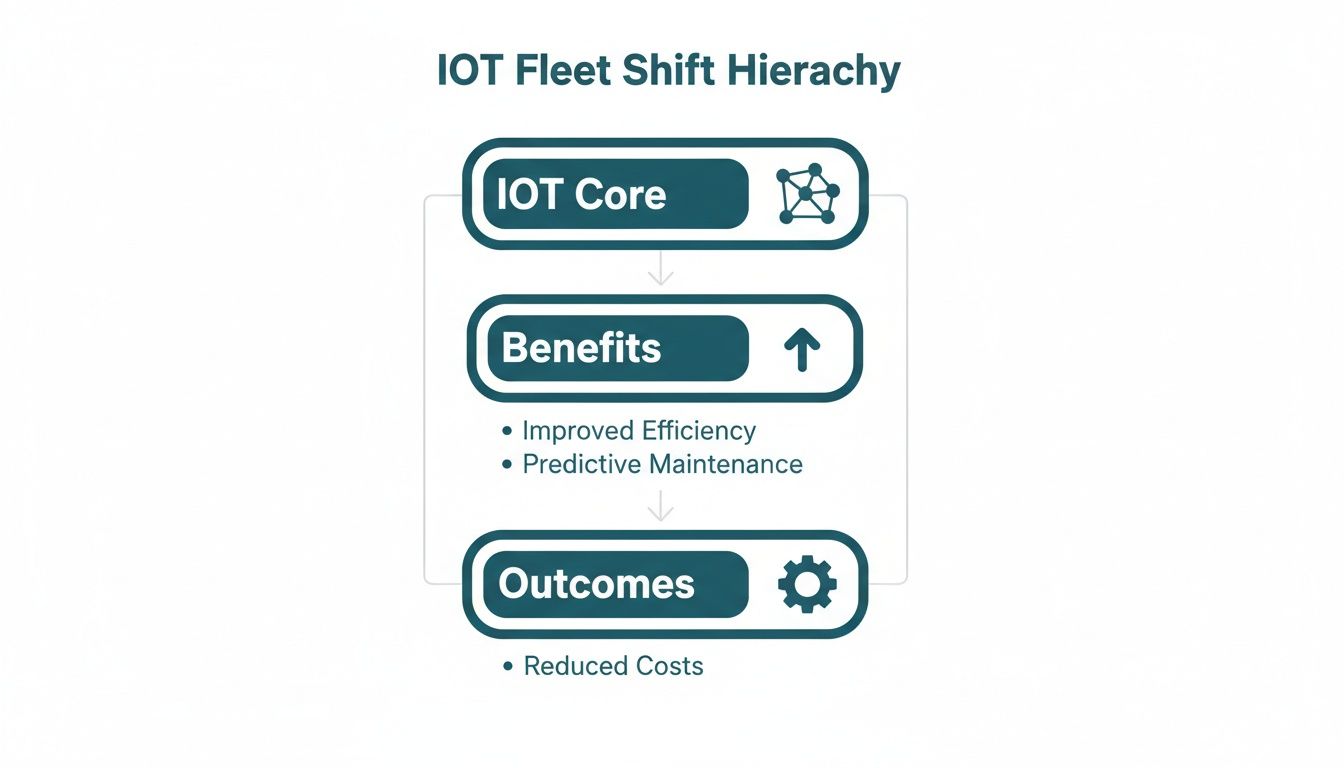

This diagram illustrates the technology hierarchy, showing how the core stack builds up to deliver operational benefits and measurable business outcomes.

The technology is merely the foundation. The real value is realized when that technology translates into more intelligent operations and a sustainable competitive advantage. Let’s dissect this architecture into its four distinct layers.

Layer 1: The Hardware and Firmware Foundation

The system originates inside the vehicle. Physical devices sense operational parameters, perform initial data processing, and transmit the data. This layer is where hardware choices have long-term consequences for data fidelity and system reliability.

Common hardware components include:

- Telematics Gateways: The central hub in each vehicle, aggregating data from multiple sources and managing the communication link.

- OBD-II Devices: A plug-and-play solution for light- and medium-duty vehicles, providing access to standard engine diagnostic codes (DTCs), fuel levels, and vehicle speed.

- Custom Sensors: For specialized requirements, such as temperature sensors for refrigerated transport, tire pressure monitoring systems (TPMS), cargo door status sensors, or in-cab cameras for monitoring driver fatigue.

The mandatory adoption of electronic logs (ELDs) demonstrates how IoT devices are already fundamentally integrated into fleet compliance and efficiency.

The firmware—the embedded software on these devices—is equally critical. It governs data collection, buffering, and security before transmission. Partnering with a team with deep expertise in custom hardware and firmware, such as professional embedded software development services, is essential for solutions tailored to specific operational constraints.

A critical tradeoff here is off-the-shelf vs. bespoke hardware. Off-the-shelf devices enable faster deployment with lower initial costs. However, they may create vendor lock-in and often lack the specific sensors or processing power required for advanced analytics, necessitating costly workarounds later.

Layer 2: Connectivity, The Data Lifeline

Once collected, data must be transmitted reliably. The choice of connectivity protocol is a balance of cost, geographic coverage, and data throughput requirements. The optimal choice is dictated by the fleet’s specific operating environment.

| Connectivity Type | Ideal Use Case | Key Tradeoff |

|---|---|---|

| Cellular (LTE/5G) | Urban and highway routes with consistent network coverage. Suitable for high-bandwidth applications like video telematics. | Higher data costs and potential for coverage gaps in rural or remote areas, which can lead to data loss. |

| Satellite | Long-haul trucking, mining, or agricultural fleets operating in remote areas with no cellular service. | Significantly higher hardware and data plan costs, plus higher latency. Best for mission-critical, low-frequency updates. |

| LPWAN (LoRaWAN/NB-IoT) | Asset tracking for non-powered equipment like trailers or containers requiring only periodic location updates. | Very low data throughput, rendering it unsuitable for real-time diagnostics or video. Optimized for long battery life and low cost. |

Layer 3: The Platform — Cloud vs. Edge Processing

The platform is the central data processing and analytics engine. A key architectural decision is where this processing occurs: in a centralized cloud environment or at the “edge” on the vehicle’s gateway.

- Cloud Processing: Offers massive scalability and storage, ideal for historical analysis, training machine learning models, and fleet-wide benchmarking. Raw data is transmitted to a central server for intensive computation.

- Edge Processing: Involves analyzing data directly on the vehicle’s telematics device. It is crucial for applications requiring near-instantaneous response, such as collision avoidance alerts or real-time driver feedback, as it eliminates network latency.

In practice, a hybrid model is often optimal. For example, an edge device can process raw accelerometer data to detect a single harsh braking event and transmit a compact alert immediately, while batching the full sensor log for later upload to the cloud for deeper trend analysis.

Layer 4: The Application and Integration Layer

This final layer transforms processed data into actionable intelligence for dispatchers, fleet managers, and executives.

This layer includes:

- Dashboards and Reporting: Visualization of key performance indicators (KPIs) like fuel efficiency, idle time, and maintenance schedules.

- Alerting Systems: Notifications for critical events such as geofence breaches, engine faults, or potential theft.

- API Integrations: This is crucial. Feeding IoT data into other business systems—such as a Transportation Management System (TMS), ERP, or maintenance software—automates workflows and creates a single source of operational truth.

When vetting vendors, scrutinize their API capabilities. A lack of robust, well-documented APIs is a red flag, indicating a closed system that will likely become a data silo.

Achieving Zero Unplanned Downtime with Predictive Maintenance

Problem: Unplanned downtime is one of the largest drains on fleet profitability. A roadside breakdown triggers a cascade of failures: missed delivery deadlines, asset rerouting, customer dissatisfaction, and significant damage to operational credibility. Traditional, schedule-based maintenance is a blunt instrument, treating all vehicles as if they operate under identical conditions, which is operationally false.

Diagnosis: The core issue is a lack of real-time, component-level visibility. Without it, maintenance is a guessing game based on mileage or calendar dates, disconnected from the actual wear a vehicle endures. This reactive model guarantees that failures will occur in the field.

Solution: IoT enables a paradigm shift from reactive repairs to proactive, condition-based intervention.

A network of sensors provides a continuous stream of health data, turning each vehicle into a self-diagnosing asset.

Real-World Scenario: Long-Haul Logistics

A long-haul logistics company operating 200 heavy-duty trucks was plagued by frequent roadside breakdowns and an inefficient maintenance schedule that often sidelined healthy trucks for unnecessary service.

They implemented a targeted IoT predictive maintenance program focused on three critical failure points:

- Engine Health: Using OBD-II ports to access the CAN bus, they began monitoring Diagnostic Trouble Codes (DTCs), engine temperature, and oil pressure in real time.

- Tire Integrity: Tire Pressure Monitoring System (TPMS) sensors were installed on all wheels to track pressure and temperature, providing early warnings for potential blowouts.

- Brake System Wear: Advanced acoustic sensors were fitted to measure subtle changes in sound frequencies indicative of brake pad degradation.

This data was streamed to a cloud platform where machine learning models analyzed patterns and flagged deviations from baseline performance. The system could now identify a specific fuel injector that was beginning to underperform or a tire that was consistently running hotter than others—a clear precursor to failure. A disciplined root cause analysis for engineering process was then applied to understand the “why” behind these deviations.

Outcome: Within the first year, the company achieved a 40% reduction in roadside breakdowns. Maintenance became a surgical, data-driven activity. Technicians were no longer performing generic inspections; they were replacing specific components that the data had already flagged as high-risk, optimizing both labor time and parts inventory.

The Business Impact of a Predictive Model

Moving from a reactive to a predictive model delivers clear, defensible business outcomes. Industry analyses show this approach can reduce unexpected downtime by up to 25% and extend a vehicle’s useful life by as much as 20%. It’s about forecasting failures before they halt operations.

Maintenance Strategy Comparison Reactive vs Predictive

| Metric | Reactive Maintenance (Traditional) | Predictive Maintenance (IoT-Enabled) |

|---|---|---|

| Downtime | Unplanned and catastrophic. High operational and financial impact. | Planned and minimal. Service is scheduled during low-impact periods. |

| Repair Costs | High. Includes emergency towing, overtime labor, and secondary damage from catastrophic failures. | Lower. Focuses on replacing single components before they cause cascading issues. |

| Technician Time | Inefficient. Spent on broad inspections and emergency repairs. | Highly efficient. Focused on specific, data-identified tasks. |

| Vehicle Lifespan | Reduced due to unchecked wear and major component failures. | Extended significantly by addressing minor issues before they become major problems. |

| Inventory | Bloated. Must stock a wide range of parts “just in case.” | Lean. Parts are ordered based on predictive failure analysis. |

Using IoT for predictive maintenance is a strategic pivot that transforms the maintenance division from a reactive cost center into a proactive engine for operational uptime and profitability.

Optimizing Fuel Spend and Driver Performance

Problem: Fuel is one of the largest and most volatile operating expenses for any fleet. The root cause of excessive fuel spend is typically a combination of inefficient routing, aggressive driving habits, and excessive engine idling. Without granular, real-time data, managers are forced to rely on broad policies that are difficult to enforce and measure.

Diagnosis: The lack of visibility into individual trip and driver behavior makes fuel waste a chronic, unmanaged cost. Traditional methods cannot provide the detail needed to diagnose specific issues, leading to persistent inefficiency.

Solution: IoT telematics provides the necessary data to create a tight feedback loop between on-road performance and operational strategy, turning raw vehicle data into actionable intelligence for cost reduction.

From Raw Data to Measurable Savings

An effective IoT in fleet management system goes beyond simple GPS tracking. It interfaces directly with the vehicle’s engine control unit (ECU) and other onboard sensors to capture high-fidelity data.

To control fuel costs, the following metrics are critical:

- Harsh Events: Flagging every instance of rapid acceleration, hard braking, and sharp cornering. These maneuvers are primary drivers of fuel waste.

- Idling Time: Precisely measuring engine run-time while the vehicle is stationary. This is a significant source of waste, especially in urban delivery operations.

- Speeding: Tracking violations of posted speed limits or internal company policies. Fuel economy degrades rapidly at higher speeds.

- Route Adherence: Comparing planned vs. actual routes to identify unauthorized detours or inefficient driver choices.

This data is used to generate objective driver scorecards. Managers can conduct data-backed coaching sessions, focusing on specific behaviors rather than subjective feedback. This approach fosters a culture of accountability and continuous improvement.

Real-World Scenario: Regional Delivery Fleet

A regional delivery company with thin margins was struggling with unpredictable fuel costs and declining on-time performance.

- Problem: Fuel costs were consistently 15% over budget, and customer complaints about late deliveries were increasing.

- Solution: The company deployed IoT telematics devices across its 50-vehicle fleet. They established baselines for idling and harsh events and implemented a data-driven driver coaching program. The system also integrated real-time traffic data to dynamically adjust routes.

- Outcome: Within six months, the fleet achieved a 12% reduction in overall fuel consumption. Idling was reduced by over 20%, and the on-time delivery rate improved significantly. The objective data also enabled a fair performance bonus program, which improved driver morale and retention.

This shift from punitive measures to data-driven coaching is critical. When drivers can see their own performance data, they become active participants in the optimization process rather than passive subjects of management scrutiny.

The results are well-documented. Fleets consistently achieve 8-15% reductions in fuel consumption by implementing telematics-based driver behavior analysis and route optimization. You can review more IoT-driven fuel savings data to see the broader industry impact. IoT provides the tools to continuously monitor, measure, and manage one of the most significant costs in any fleet operation.

Navigating Security Risks and Regulatory Compliance

Integrating IoT into a fleet introduces a new and complex attack surface. Every sensor, gateway, and data packet represents a potential vulnerability. An unsecured IoT ecosystem is not merely a data risk; it is a physical one, with the potential for vehicle tampering, operational disruption, and severe financial and reputational damage.

A common failure mode is treating security as an afterthought—a feature to be “bolted on” after deployment. This reactive posture leaves the entire operation exposed to threats that could have been mitigated by design.

Addressing Critical Threat Vectors

A resilient fleet management system requires proactive threat modeling across hardware, network, and cloud layers.

Active threats include:

- Device Tampering: Physical access can allow an attacker to compromise telematics hardware, flash malicious firmware, or use the device as a pivot point into the vehicle’s internal CAN bus.

- Data Interception: Transmitting unencrypted data creates an opportunity for man-in-the-middle (MITM) attacks to intercept sensitive operational data or inject malicious commands.

- Cloud Platform Vulnerabilities: Poorly configured cloud infrastructure, weak APIs, or inadequate access controls can expose the entire fleet’s data in a single breach.

A zero-trust security model is the only rational approach. It assumes no implicit trust and requires continuous verification for every device, user, and connection. If one component is compromised, the architecture contains the breach.

This philosophy must be implemented through non-negotiable security controls at every layer. For a deeper analysis at the device level, refer to our guide on security in embedded systems, which details the firmware-level protections that form the first line of defense.

A Framework for Security and Compliance

A robust security strategy provides a defensible posture that also satisfies regulatory requirements. This requires a multi-layered defense to protect data from the point of creation on the device to its storage in the cloud.

- End-to-End Encryption: This is non-negotiable. All data in transit must be encrypted using strong protocols like Transport Layer Security (TLS). All data at rest, whether on device memory or in a cloud database, must also be encrypted.

- Secure Firmware and Boot Processes: Devices must implement a secure boot process. This ensures that only cryptographically signed, authentic firmware can execute on the device, preventing attackers from loading malicious code. The over-the-air (OTA) update mechanism must be equally secure.

- Robust Identity and Access Management (IAM): Every device and user requires a unique, verifiable identity. The principle of least privilege must be strictly enforced. A maintenance technician’s credentials should not grant access to financial data, and a temperature sensor should not have permission to communicate with the engine control unit.

Navigating the Regulatory Maze

Alongside cybersecurity threats, operators must navigate a complex landscape of government and industry regulations.

| Framework | Area of Focus | Key Requirement for IoT Implementation |

|---|---|---|

| FMCSA ELD Mandate | Hours of Service (HOS) | Electronic Logging Devices (ELDs) must be certified by the FMCSA and transmit HOS data securely to ensure data integrity and prevent tampering. |

| GDPR | Data Privacy (EU) | For operations in the EU or handling data of EU citizens, explicit consent and robust processes for managing driver personally identifiable information (PII) are required. |

| NIST Cybersecurity Framework | Security Best Practices | While voluntary for many industries, this framework provides a proven methodology to identify, protect, detect, respond to, and recover from security incidents. |

Building a security program aligned with established standards like these is not just about protecting assets and data. It is about creating a compliant, defensible operation that reduces legal and financial risk.

Your Implementation Roadmap and Partner Selection Guide

Deploying a fully integrated IoT fleet management system is a significant undertaking. A flawed rollout can lead to operational disruption, budget overruns, and poor user adoption. A successful launch depends on a phased roadmap that minimizes risk and the selection of a technology partner based on deep technical competence, not just a polished sales pitch.

A Phased Implementation Framework

Avoid a “big bang” deployment. A gradual, methodical rollout allows for technical validation, refinement of the business case, and stakeholder buy-in without disrupting core operations.

Phase 1: The Pilot Program (1-3 Months)

Start with a representative subset of the fleet, typically 5-10 vehicles from a single operational group. The objective is technical validation and KPI baselining. Confirm that the hardware can be installed efficiently, data flows reliably, and the platform delivers the expected insights.Phase 2: The Targeted Rollout (3-6 Months)

Expand the deployment to an entire business unit or geographic region. This phase focuses on process integration. Determine how dispatchers, maintenance technicians, and managers will incorporate the new data streams into their daily workflows. This is where operational best practices are defined and documented.Phase 3: Full-Scale Deployment (6+ Months)

With a validated model and refined processes, proceed with the fleet-wide rollout. This phase is primarily a matter of logistics and scaling. The installation and training procedures should be well-established, making this the most predictable phase of the project.

Selecting the Right Technology Partner

Your technology vendor is an extension of your engineering and operations teams. The wrong choice can result in vendor lock-in, a rigid ecosystem, and long-term limitations. The evaluation must go beyond a feature checklist.

The most critical failure mode in vendor selection is prioritizing a slick user interface over a robust, well-documented API and flexible hardware. A closed system, no matter how polished it looks, will eventually become an operational bottleneck.

Use this checklist for a thorough technical evaluation:

API and Integration Support:

- Does the vendor provide comprehensive, well-documented RESTful or GraphQL APIs?

- Can you access raw, unprocessed sensor data, or are you limited to their pre-packaged analytics?

- What is their documented track record of integrating with your existing TMS, ERP, or maintenance platforms? Request specific case studies.

Hardware and Firmware Expertise:

- Do they design their own hardware and write their own firmware, or are they rebranding off-the-shelf devices? In-house engineering expertise is a significant advantage for customization and troubleshooting.

- What is their process for secure over-the-air (OTA) firmware updates? A failed OTA update can brick devices in the field, creating a logistical nightmare.

Data Ownership and Security:

- Who owns the data generated by your fleet? The contract language, reviewed by legal counsel, must state that you retain full ownership and access rights.

- How is data encrypted in transit (e.g., TLS 1.2+) and at rest (e.g., AES-256)?

- Can they speak credibly about their compliance with frameworks like GDPR or their alignment with standards from organizations like NIST?

Selecting the right implementation partner is the single most important decision in your IoT in fleet management initiative. A partner with proven engineering depth provides a foundation for future growth; a simple reseller will leave you stranded as your operational needs evolve.

Frequently Asked Questions About IoT in Fleet Management

Even for technically literate operators, implementing a comprehensive IoT strategy raises practical questions regarding data, security, and scalability. Here are concise answers to common inquiries from decision-makers.

How Much Data Does a Typical Vehicle Generate?

Data generation varies significantly based on the number of sensors and the reporting frequency. A simple GPS tracker pinging its location every 30 seconds might generate only a few megabytes per month. In contrast, a heavy-duty truck with a full telematics suite—monitoring engine diagnostics, tire pressure, cargo temperature, and driver behavior—can generate 1-2 gigabytes of data per month. High-bandwidth applications like multi-camera video telematics can increase this volume substantially.

Defining the use case first is critical, as it determines the necessary data fidelity and directly impacts connectivity costs.

What Is the Difference Between IoT and Telematics?

The terms are often used interchangeably, but there is a key distinction: telematics is a subset of IoT.

- Telematics is the technology specifically focused on monitoring remote assets, typically vehicles, via telecommunications. Historically, this meant GPS tracking and retrieving basic diagnostic codes.

- IoT (Internet of Things) is the broader concept of connecting any physical device to the internet to create an interconnected network. In a fleet context, IoT expands beyond the vehicle to include smart sensors on cargo, trailers, tools, and warehouse loading docks, creating a complete logistics ecosystem.

All telematics is a form of IoT, but not all IoT in fleet management is strictly telematics.

Can IoT Systems Be Retrofitted to an Existing Fleet?

Yes. The vast majority of fleet IoT deployments are retrofits. Most solutions are designed for aftermarket installation.

Light- and medium-duty vehicles manufactured after 1996 typically have an OBD-II port, allowing for simple plug-and-play device installation. For heavy-duty trucks or older equipment, more robust units can be hardwired into the vehicle’s power and CAN bus. Specialized sensors (e.g., for temperature or cargo monitoring) are usually self-contained and can be mounted on nearly any asset.

The primary constraint is not typically the vehicle’s age but the accessibility of its electronic systems and a suitable mounting location for hardware. A well-designed pilot program is essential for validating the installation process across all vehicle types in a fleet.

The flexibility of modern IoT hardware allows operators to add advanced data capabilities to existing assets without the capital expense of a new fleet.

Navigating these technical decisions to ensure your IoT implementation is robust and scalable requires a partner with deep engineering expertise. Sheridan Technologies specializes in designing and deploying end-to-end hardware and firmware solutions tailored to complex operational environments. Schedule a consultation to assess your fleet’s IoT readiness.