Selecting the right medical device design company is a decision that directly dictates your project's trajectory, influencing everything from budget and time-to-market to regulatory success. A well-aligned partner accelerates development, navigates complex compliance, and delivers a manufacturable, commercially viable product. The wrong one introduces catastrophic risk, leading to costly redesigns, failed validation, and significant regulatory setbacks.

This guide provides a decision-making framework for senior leaders and engineering managers, focusing on vetting a firm's true capabilities beyond surface-level presentations. We will analyze common failure modes—such as misaligned quality systems or a disregard for Design for Manufacturability (DFM)—and provide actionable criteria to select a partner who delivers both engineering excellence and measurable business impact.

Why Your Choice of Design Partner Is Mission Critical

Choosing a medical device development firm is a strategic investment, not a procurement task. A mismatch in capabilities, quality systems, or operational culture can lead to blown budgets, failed verification and validation (V&V), and devastating regulatory rejections from bodies like the FDA or EMA.

Real-World Scenario: The Consumer Tech Trap

A clear example illustrates the high stakes of this decision.

- Problem: A venture-backed startup with a novel wearable diagnostic needs to transition its functional proof-of-concept into a market-ready, Class II medical device compliant with FDA regulations.

- Diagnosis: The startup engages a design firm known for sleek consumer electronics, assuming the technical skills are transferable. The critical oversight is the firm's lack of an ISO 13485-compliant Quality Management System (QMS) and no institutional experience creating a Design History File (DHF).

- Solution (Incorrect): The partnership proceeds, yielding an aesthetically pleasing and functional prototype. However, the development process lacks the rigorous documentation required by regulators. Key design considerations like biocompatibility, sterilization validation, and risk controls under ISO 14971 are overlooked. The firmware development process fails to adhere to IEC 62304 standards for software lifecycle management.

- Outcome (Negative): The startup faces an 18-month delay and over $750,000 in unplanned costs for re-engineering the device and retroactively building the DHF with a new, qualified partner. The first-mover advantage is lost, and investor confidence is severely damaged.

This scenario highlights a crucial truth: technical skill without regulatory discipline is a liability in the medical device sector. An effective partner must integrate regulatory strategy and manufacturing realities into the design process from day one.

A design firm's QMS is not administrative overhead; it is the operational blueprint for creating a compliant, safe, and effective medical device. An inadequate or non-existent QMS is the single most significant red flag during partner evaluation.

This guide provides a structured approach to sidestep these pitfalls by evaluating core engineering depth, auditing regulatory systems, scrutinizing project management methodologies, and ensuring a seamless transition to manufacturing. By focusing on these critical domains, you de-risk your project and secure a partner that functions as a true extension of your team.

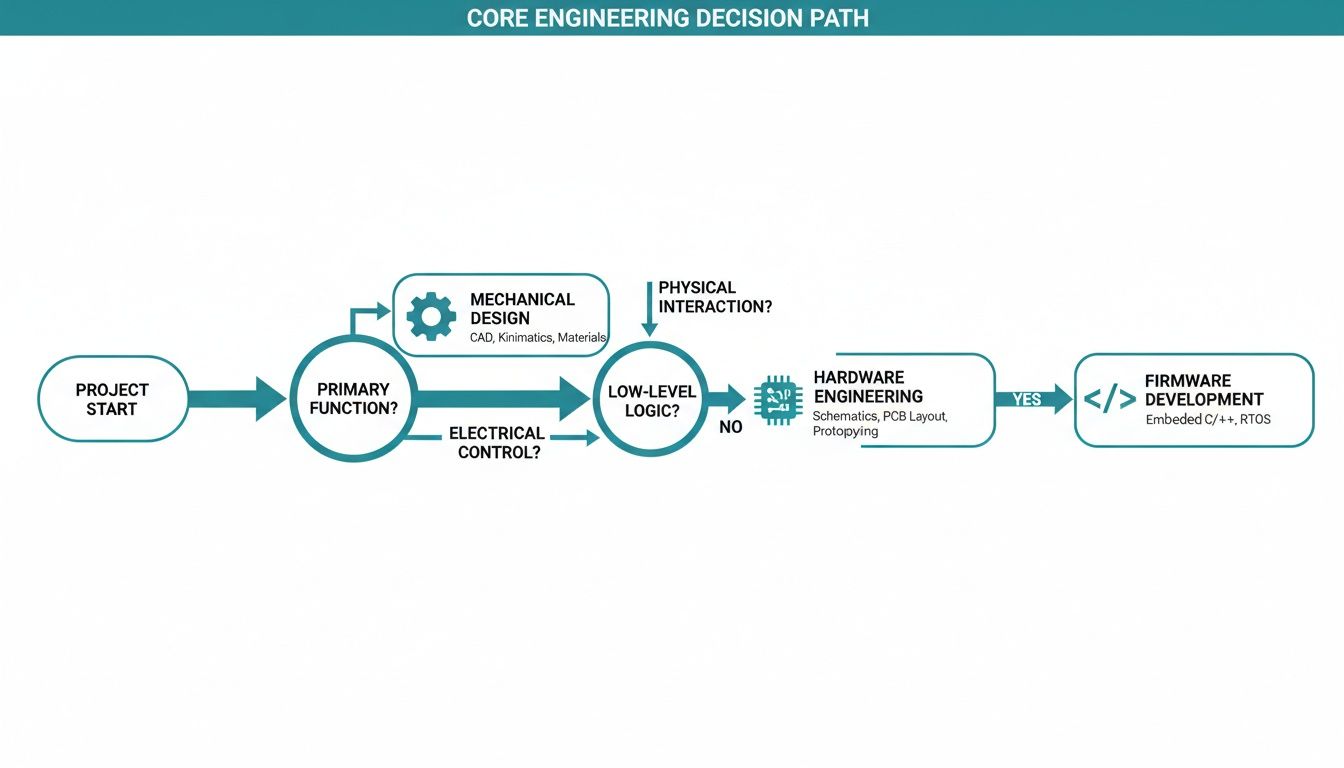

Evaluating Core Engineering and Technical Depth

Technical competence is the baseline requirement for any medical device design company. However, evaluating engineering talent in isolation is a common and costly error. In the regulated medtech industry, raw engineering skill is irrelevant if not constrained by the strict requirements of regulatory compliance and high-volume manufacturing. Your objective is to penetrate beyond marketing materials and assess demonstrated, real-world capabilities.

Risk Scenario: The EMC Failure

A common failure mode arises when a firm's experience is misaligned with the project's technical and regulatory demands.

- Problem: A diagnostics company developing a connected, point-of-care device needs a partner for hardware and firmware development.

- Diagnosis: They select a design firm with an impressive portfolio of consumer IoT products, valued for their speed and feature development in unregulated markets.

- Solution (Incorrect): The firm delivers a functional prototype ahead of schedule, impressing investors. However, the design completely ignores IEC 60601-1-2, the pivotal standard for electromagnetic compatibility (EMC) in medical equipment.

- Outcome (Negative): During formal testing, the device fails catastrophically, emitting electromagnetic noise that could interfere with other critical hospital equipment. The project halts, requiring a six-month redesign of the PCB and power systems, incinerating nearly $1 million in unplanned expenses and delaying the 510(k) submission.

This underscores the need to demand project examples that directly mirror your device's complexity, risk classification (e.g., Class I, II, III), and regulatory pathway.

Probing Firmware and Software Expertise

For modern medical devices, firmware and software are critical risk areas. A partner’s competence here is measured not by elegant code, but by disciplined adherence to IEC 62304, the international standard for the medical device software lifecycle. Vague claims of "high-quality code" are insufficient. You need evidence of a robust process.

Pose specific, evidence-based questions:

- "Can you provide a sanitized Software Development Plan from a recent Class II or Class III device project?"

- "How do you demonstrate traceability between your software requirements, architecture, and risk analysis as required by ISO 14971?"

- "Describe your V&V process. What is the structure of your unit, integration, and system testing protocols?"

A competent partner will also demonstrate expertise in clinical IT environments, including interoperability standards like HL7 and data integration with platforms like Clinical Decision Support (CDS). Understanding how a device fits into a clinical workflow is essential for market adoption. For more detail on what this entails, see how we structure our medical device development services.

An experienced medical device design partner produces auditable evidence, not just software. Every function and line of code must be traceable to a specific requirement and a risk control measure. This is the documented trail that regulators demand.

Assessing Hardware and Mechanical Design Capabilities

For hardware and mechanical engineering, the evaluation must center on two pillars: compliance and manufacturability. A firm that cannot design for the realities of production introduces significant downstream risk.

Hardware Design Evaluation

Your partner must demonstrate deep expertise in signal integrity, power management, and EMC/EMI compliance. They should be designing for testability and manufacturability from the initial schematic capture.

| Capability Area | What to Look For | Red Flag |

|---|---|---|

| Schematic & PCB Layout | Portfolio with complex, multi-layer boards (high-speed digital, low-noise analog, RF, controlled impedance). | Portfolio dominated by simple, two-layer boards for non-critical applications. |

| Component Selection | A formal process for selecting components based on longevity, medical grading, and supply chain redundancy. | Designs that rely on single-source components or parts flagged as "Not For New Design" (NRND). |

| Design for Test (DFT) | Integration of test points, programming headers (e.g., JTAG/SWD), and built-in self-test (BIST) routines from the start. | Testability is treated as an afterthought, creating major challenges for production line testing. |

Mechanical Engineering and DFM

Mechanical design extends far beyond enclosure aesthetics. The team must prove it integrates Design for Manufacturability (DFM) and Design for Assembly (DFA) into its core process. Probe their methodology for early collaboration with contract manufacturers. A team that designs in isolation and delivers a "finished" design without manufacturing input is setting your project up for costly tool modifications and production delays.

Auditing Regulatory and Quality Management Systems

Technical excellence is non-negotiable, but it is rendered useless in medical device development without an accompanying robust regulatory and quality framework. This is the area where partnerships most often catastrophically fail.

A potential partner’s Quality Management System (QMS) is not bureaucracy; it is the core operating system that ensures the final product is safe, effective, and legally marketable. Without a functional QMS, you risk not just project delays but creating a product that can never receive regulatory clearance. Your diligence must extend beyond a simple check for ISO 13485 familiarity to a forensic audit of their daily quality processes.

From Awareness to Audited Compliance

There is a significant difference between a firm that is "aware" of standards and one that operates within an audited, certified system. A certified ISO 13485 QMS is the minimum acceptable requirement. This certification provides third-party validation that their processes meet the international standard for medical device design, development, and production.

Your task is to verify that this QMS is an active, integrated part of their daily engineering workflow, not a document left on a shelf.

The most revealing question you can ask is: "Can you walk us through a sanitized Design History File (DHF) for a device with comparable complexity to ours?" The response—or hesitation—is a direct indicator of their regulatory discipline.

A well-structured DHF provides definitive proof of a functional design controls process. It must clearly demonstrate traceability from user needs through design inputs, outputs, verification, and validation, as mandated by FDA 21 CFR Part 820.30.

The table below outlines key criteria for evaluating a potential partner’s QMS.

Key Evaluation Criteria for a Design Partner's QMS

| Evaluation Area | Standard/Regulation | What to Ask For | Red Flag |

|---|---|---|---|

| QMS Certification | ISO 13485 | A copy of their current, valid ISO 13485 certificate from an accredited body. | No certification, an expired certificate, or certification from an unrecognized registrar. |

| Design Controls | FDA 21 CFR Part 820.30 | A sanitized DHF example demonstrating clear traceability from user needs to V&V. | Inability to produce a DHF, or a file that is disorganized, incomplete, and lacks traceability matrices. |

| Risk Management | ISO 14971 | Their Risk Management Plan template and a sanitized Risk Management File (RMF). | Treating risk management as a late-stage, check-the-box activity rather than an integral, ongoing process. |

| Software Development | IEC 62304 | Examples of their Software Development Plan (SDP), Software Requirements Specification (SRS), and software V&V processes. | Vague or non-existent software documentation; failure to treat software with its own rigorous, documented lifecycle. |

| Cybersecurity Controls | FDA Guidance, NIST | Documentation of their process for addressing cybersecurity risks (e.g., threat modeling, vulnerability analysis). | Dismissing cybersecurity as an "IT issue" or lacking a formal process for it during the design phase. |

| Change Control | ISO 13485, Section 7.3.7 | Their documented procedure for handling design changes post-verification, with examples of change orders. | A weak or informal change control process, which breaks traceability and can invalidate prior V&V efforts. |

This checklist provides a solid foundation for your audit. A firm that can confidently produce this evidence demonstrates a mature, integrated approach to quality and compliance. Your due diligence must also include their approach to cybersecurity, particularly for connected devices. A world-class QMS will have processes for implementing essential cybersecurity practices for healthcare providers built into the design lifecycle.

The global market for medical devices was valued at USD 640.45 billion in 2024 and is projected to reach USD 1.147 trillion by 2034, with North America accounting for over 40% of revenues (Source: Stellar MR, 2024). In such a high-stakes market, regulatory adherence is paramount. For insights into different regional requirements, see our guide on CE marking requirements for electronic equipment. A partner's QMS is your primary insurance policy against regulatory failure.

How Will They Manage Your Project? (And How Will You Pay Them?)

Disciplined project management is what separates successful projects from those that spiral out of control. World-class technical talent is of little value without a robust framework to manage scope, mitigate risk, and ensure clear communication. Without it, projects face missed deadlines, budget overruns, and late-stage integration failures.

Your evaluation must begin with the proposed engagement model. Each structure carries significant business trade-offs.

Comparing Common Engagement Models

The two most common models are fixed-bid and time-and-materials (T&M). A fixed-bid contract offers apparent budget predictability. However, medical device development is inherently unpredictable, especially during early phases. Any deviation from the initial scope necessitates a formal and often costly change order, introducing friction and slowing progress.

A T&M model provides the flexibility to adapt to unforeseen technical or regulatory challenges. The primary risk is cost control. A hybrid approach, such as T&M with a capped budget per phase, often provides an optimal balance of flexibility and financial discipline.

A best practice is to start with a small, fixed-fee discovery or feasibility phase. This allows for collaborative de-risking and requirements definition, leading to a more accurate budget and timeline for the subsequent T&M development effort. This builds trust and aligns incentives from the outset.

Insist On a Single Point of Accountability

Siloed communication is a classic failure mode. A project without a single, accountable program manager is prone to integration errors, such as firmware being developed against an outdated hardware schematic. Such mistakes can set a project back months and incur substantial costs.

Insist on a dedicated program manager with genuine technical credibility. This individual must be capable of orchestrating all engineering disciplines—hardware, firmware, mechanical, and quality—and ensuring seamless integration. They are the central hub who owns the project outcome.

The demand for such integrated services is driving market growth. The medical device design and development services market is projected to reach USD 32.91 billion by 2032, with a CAGR of 13.50% (Source: Stellar MR, 2024). This growth reflects the industry's shift toward outsourcing complex, end-to-end development to specialized firms that can provide singular, accountable leadership. You can discover more insights about these market dynamics and their drivers.

Assessing Their Agility and Process Maturity

A mature project management system is both structured and agile. When vetting a partner, push beyond surface-level claims and demand specifics on their real-world processes.

- Change Management: "Describe your change request process. Show me a sanitized impact analysis and explain your communication protocol."

- Progress Reporting: "What is the cadence and format of your status reports? Can you provide an example of a project dashboard or burn-down chart from a comparable project?"

- Risk Mitigation: "Provide your risk register template. How do you identify, quantify, and create mitigation plans for technical, regulatory, and schedule risks?"

Finally, analyze their resource model. A rigid team structure can be inefficient. A firm with a dynamic network of vetted experts can deploy specialized skills—such as an RF engineer or a sterilization consultant—at precisely the right moment, offering an agile and cost-effective approach to navigating the unpredictable path of medical device development.

Ensuring a Seamless Handoff to Manufacturing

A brilliant medical device design is commercially worthless if it cannot be manufactured reliably and cost-effectively. Many projects fail at this stage, resulting in a "benchtop hero"—a prototype that functions in a lab but is impractical to produce at scale.

This failure typically occurs when design and manufacturing are treated as sequential, disconnected phases. A top-tier medical device design company integrates manufacturing considerations from the outset, engaging contract manufacturing organizations (CMOs) as critical partners early in the concept phase. This is the most effective way to de-risk production ramp-up.

Building DFM in from Day One

Design for Manufacturability (DFM) and Design for Assembly (DFA) are not afterthoughts; they are principles that must be embedded in the design process from the start. An experienced partner makes early design choices that directly impact production yield, cost, and reliability.

Demand concrete evidence of their DFM/DFA process:

- “Can you provide a sanitized, production-ready design package delivered to a CMO?” Look for a complete package: Gerbers, a detailed bill of materials (BOM), assembly drawings, and test fixture specifications.

- “Describe your DFM/DFA process, starting from the concept phase.” A strong answer will include specific examples, such as material selection based on mold flow analysis or component placement optimized for automated assembly.

- “How do you design for test (DFT)?” A mature firm will demonstrate a clear strategy, including the integration of test points, programming headers, and self-test routines to ensure efficient production-line verification.

A partner who designs in a vacuum and then "throws the design over the wall" to a manufacturer is a liability. True partnership involves facilitating a smooth, collaborative handoff that positions the CMO for success.

Supply Chain and Component Longevity

A device's manufacturability is directly linked to its supply chain stability. The design firm's responsibility includes selecting components that are not only technically appropriate but also commercially available for the product's intended lifespan. This requires active management of component obsolescence risk.

A robust partner will have a formal process for this:

- Verifying Component Lifecycles: Using specialized tools to identify parts flagged as "Not Recommended for New Designs" (NRND) or nearing End-of-Life (EOL).

- Identifying Alternate Parts: Proactively qualifying second-source components for critical parts to mitigate supply chain disruptions.

- Managing the Bill of Materials (BOM): Maintaining a dynamic BOM with approved vendors, part numbers, and the lifecycle status of every component.

This foresight is critical. A single-source microcontroller that seems ideal during prototyping can become a catastrophic point of failure if it becomes unavailable two years into production, forcing a costly redesign and re-validation.

The market for medical device engineering services is projected to reach USD 22.54 billion by 2035, growing at a 9.0% CAGR, largely driven by increased reliance on CMOs (Source: InsightAce Analytic, 2024). This trend makes it essential to select design partners who can flawlessly manage the journey from prototype to product. As detailed in the full market analysis, deep integration with the manufacturing and supply chain ecosystem is a key differentiator for successful firms.

Answering the Tough Questions on Finding a Design Partner

Even with a structured evaluation process, several key questions often arise when selecting a medical device design partner, particularly around budgeting, timelines, and identifying critical red flags.

What's a Realistic Budget for Designing a Class II Medical Device?

Budgeting for a Class II device is highly variable, but we can establish realistic financial guardrails. For a device with moderate complexity—minimal software, straightforward mechanics—a typical budget for design, prototyping, and V&V ranges from $200,000 to $500,000.

For a more complex instrument with embedded firmware subject to IEC 62304, wireless connectivity, and a novel mechanical design, the budget to reach the point of regulatory submission can easily exceed $1 million.

Be wary of low fixed-bid quotes. While they offer apparent predictability, they often lead to costly change orders when the scope inevitably evolves. A transparent, milestone-based T&M model with budget caps typically provides a better balance of flexibility and financial control.

How Long Does the Medical Device Design Process Typically Take?

Timelines are directly correlated with device classification and technical complexity.

- Class I Device: A simple, low-risk device can often proceed from concept to market in 9-12 months.

- Class II Device: For a device requiring a 510(k) submission, a realistic timeline is 18-36 months. This includes the full design cycle, testing, and the FDA's review period.

- Class III Device: High-risk devices requiring Premarket Approval (PMA) involve a much longer journey of 3-7 years, primarily due to the extensive clinical data required.

An experienced design partner can accelerate this process by designing for testability and proactively addressing regulatory hurdles, but the timelines dictated by regulatory bodies are largely fixed.

What Are the Biggest Red Flags When Interviewing a Design Firm?

While some red flags are obvious, others are more subtle yet signal fundamental deficiencies.

- No Formal ISO 13485 QMS: This is an immediate disqualifier. It indicates a lack of foundational processes for compliant medical device development.

- Vagueness on Design Controls: If a firm cannot clearly articulate its design controls process or is hesitant to show a sanitized Design History File (DHF), it suggests their system is not robust or repeatable.

- A Mismatched Portfolio: A portfolio dominated by consumer electronics indicates a lack of experience with the specific engineering discipline and regulatory mindset required for medical devices.

- An Inexperienced Project Lead: Your primary point of contact must be fluent in medical device standards. If they cannot confidently discuss ISO 14971 (risk management) or IEC 62304 (software), it signals a critical expertise gap in project leadership.

Should I Choose a Large Firm or a Specialized Boutique?

This choice presents a trade-off between scale and specialization. A large, full-service firm may offer a comprehensive suite of in-house capabilities but can be bureaucratic and may assign junior resources to your project. A specialized boutique firm typically provides direct access to senior-level expertise and more focused attention, but may have narrower in-house capabilities.

A hybrid model—a firm with a core team that leverages a dynamic network of vetted specialists—can offer an optimal balance. This structure combines the agility and senior focus of a boutique with the ability to deploy precisely the right expertise for each project phase, without the overhead of a large organization. Regardless of the model, the presence of a single, accountable program lead is non-negotiable.

Making the Final Decision

After completing technical due diligence, auditing quality systems, and analyzing project management frameworks, the final decision must integrate both objective data and qualitative factors. This is not merely vendor selection; it is the formation of a multi-year strategic partnership.

Use a decision matrix to score each potential partner on the criteria covered—from ISO 13485 certification to DFM process rigor. This provides an objective baseline. However, do not let quantitative scores alone drive the final choice. Consider the intangibles from your interactions:

- Which team demonstrated the most transparency?

- Who posed the most insightful questions regarding your user needs and clinical workflow?

- Who operated less like a contractor and more like a collaborative extension of your own team?

A technically superior firm that is a poor cultural fit can create significant friction. Misaligned communication styles and expectations have derailed many projects.

The right partnership is a strategic alliance built on transparent communication and a shared vision for the outcome. Technical skill is the price of entry; cultural and process alignment drive long-term success.

The path from concept to a compliant, market-ready medical device is fraught with complexity. Sheridan Technologies provides the end-to-end engineering and regulatory expertise needed to navigate every stage successfully.

If you are facing technical or regulatory challenges, a brief, no-obligation consultation can provide clarity on your path forward. Start the conversation with our engineering team today.