Searching "product development companies near me" is a natural first step, but it’s an operational mistake. For technical leaders managing complex hardware programs, proximity is a poor proxy for capability. The stakes—blown budgets, missed market windows, and prototypes that are impossible to manufacture—are too high to let geography drive a critical partnership decision. The best local firm might excel at industrial design but lack the rigorous systems engineering, firmware discipline, or manufacturing readiness your product demands.

This guide is for VPs of Engineering, CTOs, and Program Managers responsible for shipping high-reliability hardware. It is not for teams seeking simple app development or a purely aesthetic design engagement. We will reframe the search from a local vendor query to a disciplined evaluation of a partner's technical depth, process maturity, and ability to de-risk the transition from prototype to production. The goal isn't to find a firm that's nearby; it's to qualify a partner whose operational DNA matches the complexity of your product.

- Learn to diagnose technical depth by asking pointed questions about their discovery process, verification strategy, and risk management artifacts.

- Evaluate their manufacturing readiness by interrogating their approach to DFM, DFT, and closed-loop failure analysis systems like FRACAS.

- Structure an engagement for success by defining clear, gated deliverables and choosing a commercial model that aligns with your program's risk profile.

Beyond a Local Search: Defining Your Core Problem

Before you start vetting partners, the most critical work is internal. A vague project brief attracts unfocused partners, wasting everyone's time. A well-defined Statement of Work (SOW) or problem statement is your most powerful filter. It forces clarity on your technical requirements, target COGS, and critical constraints, such as regulatory compliance with ISO 13485 (medical devices) or DO-178C (aerospace). If your project requires deep RF engineering or specific clean-room protocols, stating this upfront ensures only qualified firms respond.

A strong SOW doesn’t hide risk; it surfaces it. By identifying known failure modes—a fragile supply chain, complex firmware integration, a novel sensor—you attract partners built to solve hard problems, not just execute simple tasks. This candor signals operational maturity and attracts high-performing engineering teams.

Articulate Your Project's Current State

Your SOW must clearly define the project's current phase. Is a partner inheriting a well-documented architecture or a back-of-the-napkin sketch? This context dictates the required skills and process rigor.

Be specific about where you are:

- Discovery / Architecture: Are you still defining the system requirements document (SRD), creating a risk map, and building an architecture decision log (ADL)?

- EVT (Engineering Validation Test): Do you have early prototypes for bring-up and core functional validation? The focus is on proving the core design works.

- DVT (Design Validation Test): Is the design frozen? Is the focus now on comprehensive verification, environmental testing, and compliance readiness?

Stating your phase plainly helps a firm understand the immediate challenges. The expertise needed for early-stage electronics design services is vastly different from what’s required to transition a DVT build to a contract manufacturer. The market for product design services is projected to reach USD 32,926.4 million by 2030, driven by growth in complex areas like manufacturing transfer. Top-tier firms achieve 20-25% faster cycle times because they possess the lifecycle discipline to manage these transitions. You can find more data in this comprehensive market analysis.

Define Success and Identify Critical Risks

Your brief must define what a "win" looks like in measurable terms. What are the key performance indicators (KPIs) that matter? Battery life? System uptime? Data throughput? Be explicit about the one or two metrics you cannot compromise on.

Equally important is acknowledging the known unknowns. What are the top three risks that keep you up at night?

Use Case: Medical Wearable with Stringent Power Constraints

- Problem: A team is developing a Class II medical wearable for remote patient monitoring. The device must operate for 7 days on a single coin-cell battery while maintaining a reliable BLE connection.

- Stakes: Failure to meet the power budget makes the product commercially non-viable. Unreliable connectivity compromises patient safety and invalidates clinical data.

- Required Expertise: The ideal partner must demonstrate deep expertise in ultra-low-power firmware design, analog front-end optimization for the PPG sensor, and a rigorous verification strategy for BLE link stability and power consumption under various operating states. A generic "IoT firm" is insufficient.

By defining your needs with this precision, you attract partners who think in systems and de-risk the entire product lifecycle from day one.

How to Diagnose a Firm’s True Technical Capabilities

A slick portfolio proves a firm can produce an outcome, not that they have a repeatable, disciplined process. To assess true engineering capability, you must probe the firm's systems for managing complexity and reducing risk. Their answers reveal the difference between a "design-and-toss" shop and an end-to-end partner capable of navigating a product from concept to scaled production.

Moving Beyond Portfolio Questions

Your goal is to find evidence of disciplined engineering practices that directly reduce program risk. Ask questions that force a firm to show you how they think and document critical information.

Probe these critical areas:

- Architecture & Documentation: "Show me an example of an Architecture Decision Log (ADL) you maintain." A high-maturity firm will present a living document capturing not just final choices but rejected options and the trade-offs considered. This artifact is essential for continuity and prevents the team from re-litigating decisions.

- Verification & Validation (V&V): "Walk me through your V&V planning process for a product like ours." Listen for a requirements-driven approach. They should describe how system requirements are decomposed into verifiable test cases with clear pass/fail criteria for each gate (EVT, DVT, PVT). Anything less is ad-hoc and high-risk.

- Design Controls: "Describe your Engineering Change Order (ECO) process between EVT and DVT." A strong answer will detail a formal system for managing changes after a design freeze. This prevents scope creep and ensures changes are evaluated for their impact on cost, schedule, and risk.

A firm’s ability to articulate processes for managing change, documenting decisions, and planning verification is a direct indicator of their ability to handle complexity. These systems prevent minor issues from becoming catastrophic downstream failures.

Assessing Design for 'Everything' (DFx)

A capable partner doesn't just design a prototype that works on a lab bench; they design for the entire product lifecycle. Their expertise in Design for "X" (DFx) is a powerful signal of their readiness to help you scale.

Specifically, interrogate their approach to Design for Testability (DFT). Ask, "How do you incorporate DFT principles into your hardware designs?" A competent answer will include specifics like defining test point strategies, incorporating boundary scan (JTAG) for automated testing, and designing firmware hooks for manufacturing test fixtures from the outset. This discipline is a hallmark of high-performing teams, as it dramatically reduces the cost and time of manufacturing validation. You can learn more about choosing the right product development firm.

Another indicator of process maturity is engagement with structured R&D programs like the Government of Canada's NRC Industrial Research Assistance Program (IRAP). Participation often signals a commitment to accountable, well-documented engineering.

Technical Capability Evaluation Checklist

Use this table to guide your evaluation of a firm's engineering depth and process maturity.

| Domain | Key Evaluation Question | What a Strong Answer Looks Like |

|---|---|---|

| Requirements Management | How do you ensure traceability from system requirements to verification test cases? | They describe using a dedicated tool (e.g., Jama, Jira) and can show a requirements traceability matrix (RTM) that links every requirement to specific V&V activities. |

| System Architecture | Can you show us an example of an Architecture Decision Log (ADL) and explain how you maintain it? | They present a clear log detailing what was chosen, why it was chosen over alternatives, and the associated trade-off analysis (e.g., cost, power, complexity). |

| Hardware Engineering | What is your process for schematic and PCB layout reviews? Who is involved? | They describe a formal, multi-stage review process (schematic, placement, routing) with peer reviews, checklists, and sign-offs from relevant disciplines (e.g., firmware, mechanical) before fabrication. |

| Firmware & Embedded | How do you instrument firmware for field diagnostics and manage OTA updates safely? | They discuss structured logging, telemetry, remote debug capabilities, and strategies for OTA rollback, compatibility, and security (e.g., signed images). |

| Verification & Validation | Walk us through your test coverage planning process. | They outline a plan that maps each requirement to a specific verification method (test, analysis, inspection) and defines entry/exit criteria for EVT, DVT, and PVT gates. |

| Manufacturing Readiness | How do you incorporate Design for Test (DFT) and Design for Manufacturability (DFM) into your process? | They provide specific examples: adding test points for bed-of-nails fixtures, creating panelization strategies, and engaging the contract manufacturer during the layout phase for DFM review. |

| Risk & Change Management | Describe your risk management process and your ECO process post-design freeze. | They can show a risk register (e.g., FMEA) and a formal ECO workflow with an impact analysis on cost, schedule, and validation requirements. |

A firm that can confidently answer these questions has the operational discipline required to ship complex products successfully.

Evaluating a Partner’s Manufacturing and Supply Chain Readiness

A brilliant prototype that cannot be manufactured reliably at scale is a business failure. This is where many promising products stumble. A partner's manufacturing readiness—their expertise in Design for Manufacturing and Assembly (DFM/DFA), production test strategy, and supplier orchestration—is as critical as their design skill. The global industrial design market is projected to reach USD 82.3 billion by 2035, with growth fueled by firms that integrate manufacturability from day one. Top performers see success rates of 76% versus 51% for laggards, largely because designing for the factory floor accelerates time-to-market and reduces costly late-stage revisions, as highlighted in this market intelligence report.

From Design to Production: A Closed-Loop System

A top-tier partner operates a closed-loop system between design, production, and field data. They design the entire system needed to build, test, and support the product. A key indicator of this maturity is their process for Failure Reporting, Analysis, and Corrective Action (FRACAS). A robust FRACAS process demonstrates they can systematically learn from production failures and feed those insights back into design improvements. For high-reliability products, this is non-negotiable.

Ask a potential partner: "Walk me through a time a product you designed had a low yield at the CM. What was your process for root cause analysis, and how did you implement and validate the corrective action?" Their answer will reveal their real-world operational depth.

Designing for Supply Chain Realities

An otherwise perfect design can be crippled by a single, sole-sourced component going end-of-life. A strategic partner mitigates this risk from the beginning.

They should speak fluently about:

- Component Lifecycle Management: Proactively monitoring component availability and planning for obsolescence.

- Second-Sourcing Strategy: Identifying and qualifying alternative parts for critical components early in the design cycle, not as a reactive fire drill.

- CM Orchestration: Demonstrating experience in transferring designs, test fixtures, and documentation to a contract manufacturer for production ramp.

This foresight is what separates a smooth product launch from a costly delay. The ability to navigate the transition from a working prototype to a scalable product is the ultimate test of a firm's capability.

Structuring the Engagement for Success

The contract and communication cadence you establish are as critical as the engineering itself. A poorly structured engagement leads to misaligned expectations, scope creep, and budget overruns. The goal is to create a partnership built on shared accountability, transparency, and a disciplined operational rhythm.

Choosing the Right Engagement Model

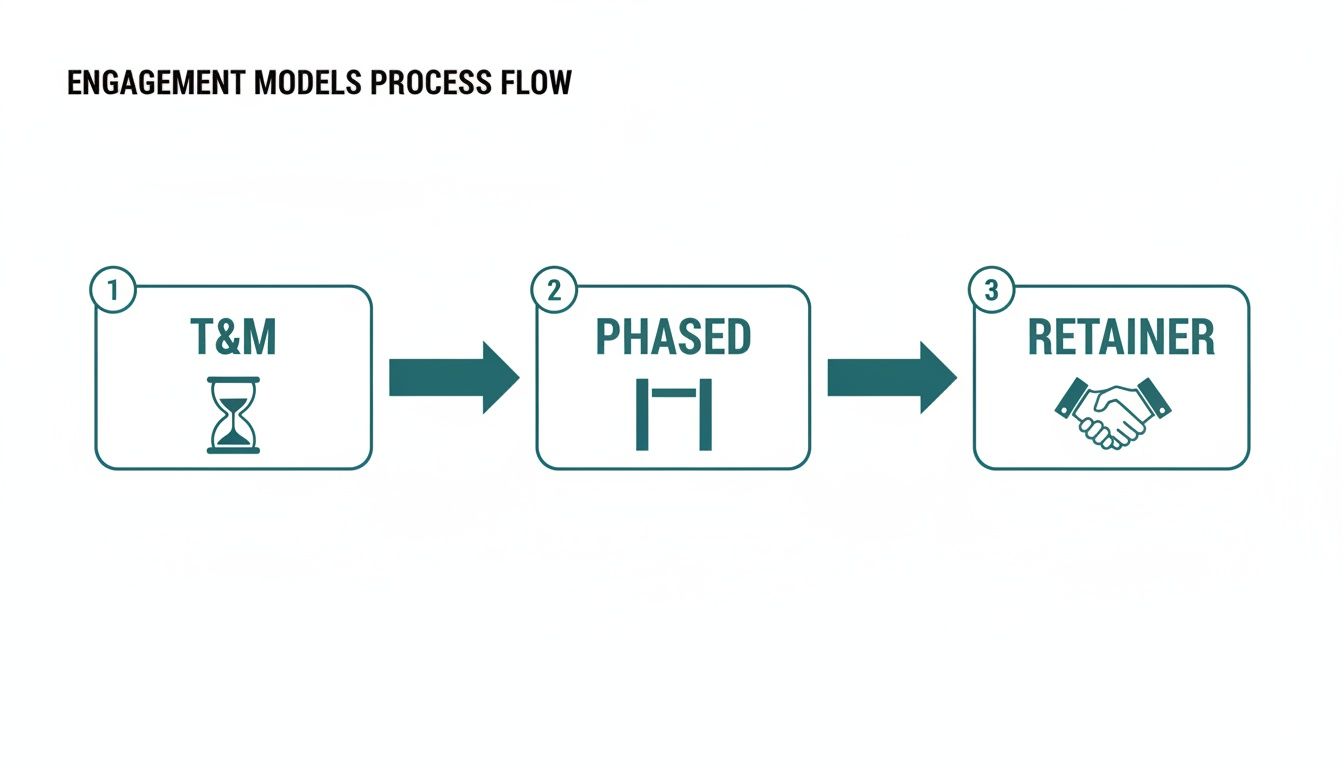

The right commercial model depends on your project's maturity and level of uncertainty.

- Time and Materials (T&M): Ideal for early-stage discovery and R&D where the scope is fluid. It provides maximum flexibility but requires active management to control costs.

- Fixed-Bid: Best for well-defined, low-risk work packages, like a DVT test cycle or a minor PCB revision. It offers cost predictability but is rigid; changes often require painful re-negotiation.

- Dedicated Team / Retainer: The right choice for complex, long-term programs requiring deep integration. It fosters true technical ownership but represents a significant commitment.

A hybrid approach is often most effective. Start with T&M for initial discovery and architecture. Once the design is stable, transition to phased, fixed-bid milestones for EVT, DVT, and PVT builds.

Critical Detail: Ensure the intellectual property (IP) clause in your contract unequivocally assigns all developed IP to your company. Vague language here is a common and disastrous failure mode.

Defining Deliverables and Operational Rhythm

Success requires a disciplined communication cadence. A weekly risk burn-down meeting focused on identifying and mitigating the top program risks is non-negotiable. Your SOW must also define concrete, measurable deliverables for each phase, such as a signed-off System Requirements Document (SRD) or a completed EVT build report. These artifacts serve as objective gates, ensuring one phase is complete before committing resources to the next.

Even with a slight slowdown in global R&D growth, digital tools are poised to boost efficiency by 19% and slash time-to-market by 17%. This highlights the need to partner with firms that use data-driven processes to deliver measurable outcomes, especially when capital is constrained, as detailed in this global innovation analysis.

Turning Theory Into Action: Qualifying Your Partner

The biggest mental shift is moving from "finding a local vendor" to "qualifying a strategic partner." For teams building complex hardware, especially in regulated industries, the best partner is not the one "near me;" they are the one whose processes are aligned with your business outcomes.

From Evaluation to Engagement

As you shortlist firms, a formal vendor risk assessment is a mandatory step to vet their operational and financial stability. You need a partner who will be there for the long haul. Use the evaluation checklist from earlier to score and compare potential partners objectively, removing bias from the decision.

A partner’s real value isn't just in their engineering skill; it's in their demonstrated ability to reduce your program risk. Scrutinize their process maturity, communication discipline, and manufacturing readiness with the same rigor you apply to their technical portfolio.

The infographic below outlines the three most common engagement models. Understanding the trade-offs between flexibility, cost, and control is key to selecting the right structure for each phase of your program.

Common Questions in Partner Selection

Here are straight answers to the questions we hear most often from CTOs and engineering leaders.

How Much Does It Cost to Hire a Product Development Company?

Costs range from tens of thousands for a tightly-scoped project to over $500,000 for the full-cycle development of a complex system like a regulated medical device. The final cost depends on technical complexity, scope, and engagement structure. However, focusing only on the quote is a mistake. A cheaper firm that neglects DFM can create millions in downstream costs from manufacturing rework, product failures, and missed market windows. The better question is: "What is the total cost of ownership to successfully bring this product to market?"

What Is the Difference Between a Product Design and a Product Development Firm?

Product design firms typically focus on industrial design, aesthetics, and user experience (UX). They make a product look and feel good.

Product development firms, like Sheridan Technologies, are end-to-end engineering partners. We own the hardware, firmware, and software engineering, as well as the rigorous verification, validation (V&V), and manufacturing readiness required to ship a reliable product. For any complex electronic device, a development partner is essential to de-risk the transition from prototype to a scalable, manufacturable, and field-ready system.

A design firm ensures your product feels right in a user's hand. A development firm ensures it won't fail when it's being built by the thousands in a factory.

When Is the Right Time to Engage a Product Development Partner?

Ideally, you engage a partner during the concept or architecture phase. Early involvement allows their expertise in DFM, DFT, and risk management to shape critical decisions that have massive downstream impact on cost and reliability. An experienced partner helps map program risks from day one and establishes a clear plan to navigate the EVT, DVT, and PVT gates, preventing costly late-stage surprises. That said, strong firms can also execute program rescues, providing the diagnostic skill to identify root causes and get a stalled project back on track.

Finding a partner who can expertly guide you from concept to a production-ready system is one of the most critical decisions a technical leader will make. Sheridan Technologies offers architectural reviews and manufacturing readiness assessments designed to de-risk your program and accelerate your time to market.